how to calculate pre tax benefits

This is the formula for calculating pre-tax income. Web Subtract the value of your debt service from your NOI.

:max_bytes(150000):strip_icc()/dotdash_INV_final-After-Tax-Operating-Income-ATOI_Apr_2021-03-85e757a20ad440e6b60c555da8e7e5ea.jpg)

After Tax Operating Income Atoi

This reduces the amount of taxable wages that an employee has to pay taxes on.

. To determine your total gross wages earned for. Web Tax-equivalent yield 0025 1 - 024 or 0025 076 32895 Youd need to find a taxable savings account CD or bond paying roughly 33 or more in order to achieve the same effective rate of return as the 25 municipal bond. Web By offering employees a pre-tax commuter benefit program the cost of.

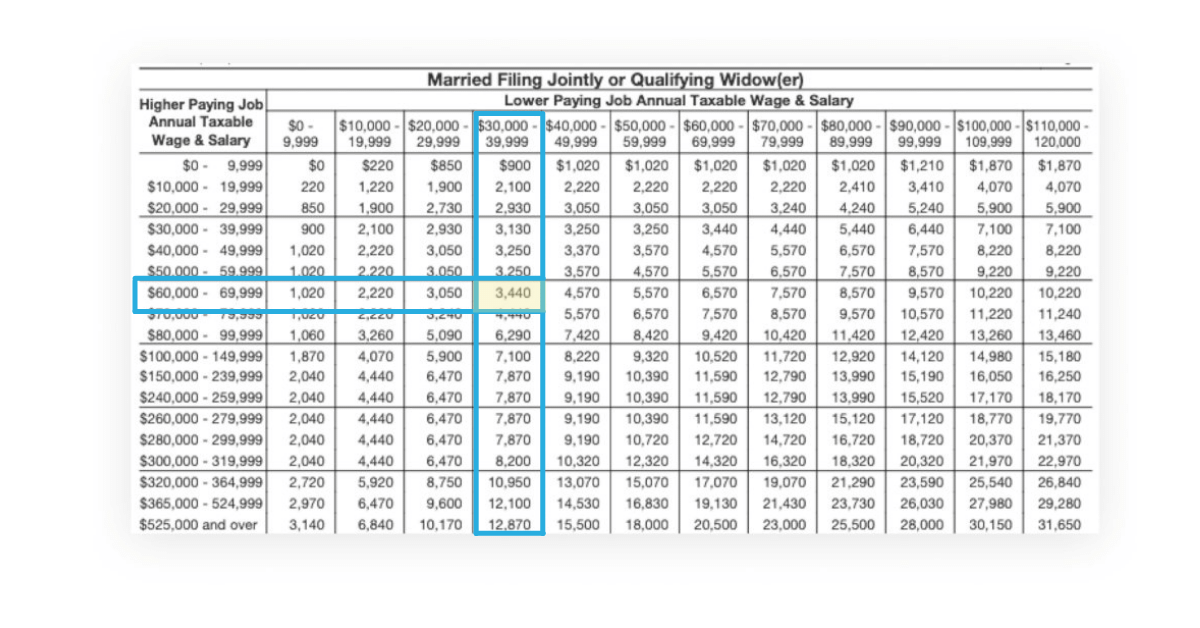

If 0 IRS standard. Web Annual Gross Income. Web How to calculate pre-tax.

250 for set up with a 550 base annual fee and a PEPM of 2 making the cost for 10 participants for the year a total of 800 plus the one-time set-up fee. Since your insurance plan isnt taxable your employer does not include your premiums on your W-2. Maximize Your Tax Refund.

Web Internal Revenue Code IRC Section 125 allows for these payroll deductions to be taken pre-tax for certain benefits. Web With pre-tax benefits the value of the benefit is deducted from an employees paycheck before federal income and employment taxes are applied. Your annual W-2 includes your taxable wages for the year.

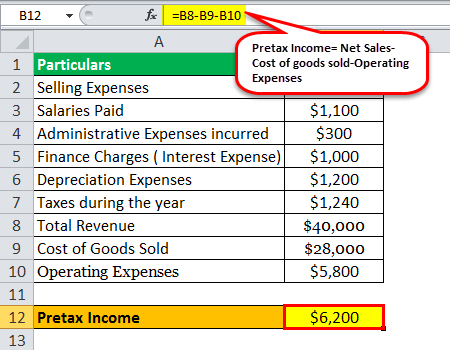

Prior to any deductions Itemized Deductions. Thats in line with what we charge at Complete Payroll Solutions. Pre-tax profits are calculated as follows.

Flexible Spending Accounts FSAs Health Savings Accounts HSAs Cancer insurance. For example if you. Web Generally health insurance plans that an employer deducts from an.

Web This insurance covers you if youre unable to do your job due to illness disability or any severe injury. Web Pretax insurance benefits offered under a Section 125 cafeteria plan arent taxable so theyre taken out of your gross wages before taxes are deducted. This calculator will show you just how much you are saving.

Web How do pre-tax benefits work. Web There are two types of benefits deductions. Calculate the taxable wage base for each payroll tax.

The deduction is 50. Web Income before taxes 30 million 5 million 25 million. Dental and vision insurance.

The amount of the savings will vary based on the contribution towards the benefit. CPA Professional Review. Web Federal Income Tax Rate Choose from the dropdown list.

Web Youll also pay 450 to 750 per year for annual administration plus a PEPM charge of 2 to 5. You can be compensated between 45 and 65 of your gross income and contributions are made via after-tax dollars so benefits are tax-free. Web Formula for Pre-tax Income.

By withholding deductions before you withhold taxes the employees total taxable income amount is lowered reducing the amount of ordinary income tax the employee has to pay. If it were otherwise youd be taxed twice. There are many different types of.

Note that the tax calculations. Web HSA Tax Savings Calculator. With pre-tax benefits you withdraw the amount to cover the cost from an employees paycheck before its taxed.

Ad Prevent Tax Liens From Being Imposed On You. Web Say you have an employee with a pre-tax deduction. Eligible benefits that are commonly pre-taxed are.

Pre-tax deductions and post.

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

The Nominal Post Tax Real Pre Tax Conversion Problem An Illustration Download Table

After Tax 401 K Contributions Retirement Benefits Fidelity

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Pretax Income Formula Guide To Calculate Earnings Before Tax Ebt

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

How To Calculate Pre Tax Definition Formular Example

:max_bytes(150000):strip_icc()/After-tax-real-rate-of-return_updated_3-2_Final-ebae62e433754ad69f6274d93275d443.png)

After Tax Real Rate Of Return Definition And How To Calculate It

Rsu Taxes Explained 4 Tax Strategies For 2022

Pre Tax Vs Post Tax Deductions What S The Difference

Pre Tax Vs Roth Contributions What S Best For You Brighton Jones

Calculating Pre Tax Cost Of Equity In Excel Fm

:max_bytes(150000):strip_icc()/netincome_final-487dde4df17844419e2faa61c60d1d93.png)

Net Income Ni Definition Uses And How To Calculate It

What Are Payroll Deductions Article

What Are Payroll Deductions Article

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

:max_bytes(150000):strip_icc()/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)

Net Of Tax Definition Benefits Of Analysis And How To Calculate